At ZorroSign, we are huge advocates of blockchain technology and its role in the metaverse and web3. We truly believe that the future for maintaining the highest level of security and privacy for businesses and online transactions is rooted in blockchain solutions.

Dubai is a city embracing the use of blockchain technology and wooing forward-thinking entrepreneurs. It has a history of visionary innovation, having already attracted 1,000 companies in the blockchain and metaverse space.

Recently, Dubai hosted the Future Blockchain Summit—the MENA region’s longest-running exhibition and conference connecting key stakeholders across Blockchain, crypto and Web3. “Dubai is seen as the main hub for blockchain and Metaverse,” said LandVault CEO, Sam Huber, in a recent article in the Khaleej Times. Let’s take a closer look at the blockchain initiative that is taking place in Dubai . . .

Dubai’s Blockchain Strategy

Dubai has taken a global lead in the use of blockchain technology with the Dubai Blockchain Strategy launched in October 2016 by His Highness Sheikh Mohammed bin Rashid Al Maktoum— propelling Dubai to be the first city in the world to conduct applicable government transactions via blockchain by 2020.

From that bold initiative—focused on improving government efficiency, creating new industry, and leading the world with paperless operations—Dubai has continually explored and evaluated distributed ledger technology innovations that demonstrate an opportunity to deliver more seamless, safe, efficient, and impactful city experiences.

It was from that 2016 vision that ZorroSign’s co-founder and CEO, Shamsh Hadi, drew inspiration to map his company’s emerging eSignature solution to blockchain. In the years since, ZorroSign has built a multi-chain blockchain platform uniting digital signatures, identity-as-a-service, automated compliance, and many more web3 technologies to support not only Dubai’s paperless initiatives and the vision of Sheikh Mohammed, but paperless operations for businesses, governments, and individuals around the world. Dubai’s blockchain strategy was a key beginning!

Dubai’s Metaverse Strategy

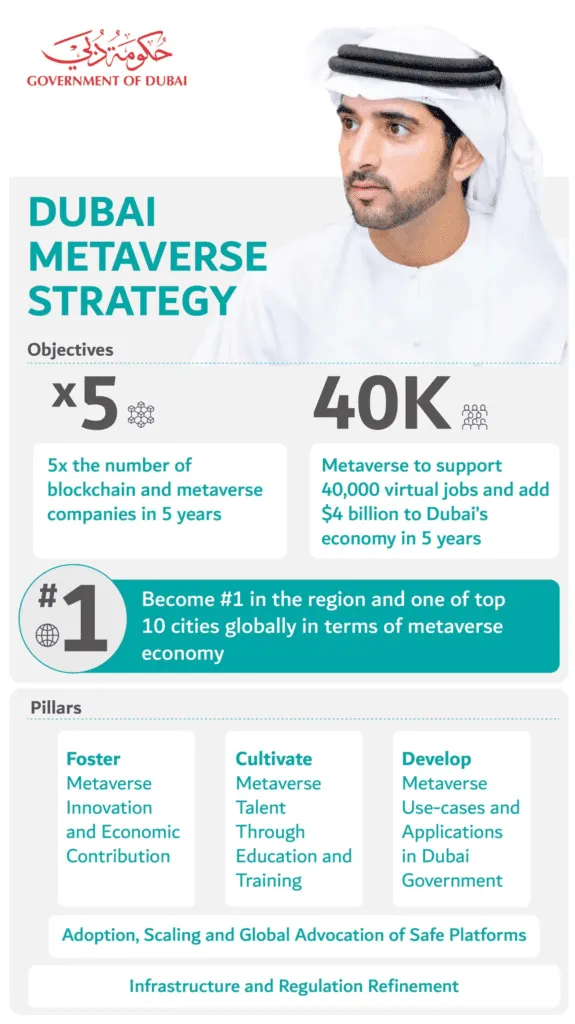

In September 2022, H.H. Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of Dubai Executive Council, launched the Dubai Metaverse Strategy—aiming to turn Dubai into one of the world’s top ten metaverse economies as well as a global hub for the metaverse community.

“The Dubai Metaverse Strategy seeks to:

- “Foster innovation, enhance the metaverse’s economic contributions through research and development collaborations, and promote advanced ecosystems utilizing accelerators and incubators that attract companies and projects to Dubai;

- “Foster talent and invest in future capabilities by providing the necessary support in metaverse education aimed at developers, content creators and users of digital platforms in the metaverse community; and,

- “Develop web3 technology and its applications to create new governmental work models and development in vital sectors, including tourism, education, retail, remote work, healthcare and the legal sector.”

Smart Dubai

“After the successful implementation of the strategy to transform Dubai into a Smart City by 2017, Dubai Government launched the Smart Dubai 2021 Strategy.”

With goals of customer happiness, economic growth, and resource and infrastructure resilience, the Smart Dubai 2021 Strategy presents six strategic objectives to achieve:

- A “smart livable and resilient city” — achieving full information and communication technology (ICT) enablement of critical infrastructure, enhancing resilience and delivering an integrated, sustainable urban experience.

- A “globally competitive economy powered by disruptive technologies” — digitally transforming economic sectors, transitioning to sustainability while fostering vibrant entrepreneurship and innovative ecosystems.

- An “interconnected society with easily accessible social services” —digitizing and simplifying access to services for residents and visitors, improving the quality of life and streamlining social, cultural, education, and healthcare experiences in the emirate.

- “Smooth transport driven by autonomous and shared mobility solutions” — pioneering mobile solutions for a seamless and safe transportation experience, harnessing autonomous transportation technologies, and reducing time spent commuting.

- A “clean environment enabled by cutting-edge ICT innovations” — deploying technologies that ensure sustainability and quality of the emirate’s resources (water, air, energy, and land), improving resource efficiency and conserving consumption, and digitally transform utilities/manufacturing/transportation to reduce the emirate’s carbon footprint.

- A “digital, lean connected government” — i.e., “a government with zero visits” eliminating the need to commute to and physically interact with the government via paperless, cashless government operations delivering optimized experiences and powered by world-class city-wide shared services and infrastructure.

“The Digital Dubai initiative represents a vision to recreate the traditional top-bottom city management model into one that is representative and sustainable,” writes David Ndichu for Gulf Business. “Data is the foundation for the smart city Dubai aspires to be and the emergent digital economy the country is fostering.”

ZorroSign and Dubai

ZorroSign’s CEO and co-founder, Shamsh Hadi, is a third-generation member of the Hadi family who have called Dubai their home for the last 55 years.

ZorroSign’s multi-chain blockchain technology supports Dubai’s blockchain strategy, metaverse strategy, Smart Dubai 2021 strategy, and paperless initiatives while helping organizations around the world move to private, secure paperless operations. Our technology was built from the ground up using private, permissioned Hyperledger Fabric blockchain—the blockchain architecture deployed by Amazon Web Services, IBM, Intel, Mastercard, Microsoft, PayPal, and more—and ZorroSign’s platform today also supports public, permissionless Provenance Blockchain.

When privacy and security is mission critical, organizations from Dubai to Dublin, Dallas to Dhaka need ZorroSign for digital signatures, transactions, and documentation. Put ZorroSign’s blockchain platform to the test by signing up for a free trial today at https://www.zorrosign.com/new/